Car mileage depreciation calculator

No text Own years 1. The car depreciation rate depends on the age of the car its mileage and the below depreciation table.

How Car Buy Rater Works The Methods It Uses To Evaluate Cars

New tires for my car cost around 600 and are rated for about 60000 miles roughly every 2 years with how much I drive.

. Your mileage write-off would be 3025. Select a Vehicle MakeManufacturer. It can be used for the 201314 to.

Car Depreciation Calculator Enter your model data to get a custom graph and table based on model year and mileage driven. Work-related car expenses calculator. This means of course that your depreciation costs will be.

The longer you own the car the lower will be the average annual cost of depreciation. Using the Car Depreciation calculator To use the calculator simply enter the purchase price of the car and the age at which the car was when it was purchased by you 0 for brand new 1 for 1. We will even custom tailor the results based upon just a few of.

The result shows how much the depreciation is anticipated to be in the first year and during the total. Car Age 1 year 2 years. Select Make Input For Estimated Current Value USD 1.

By entering a few details such as price vehicle age and usage and time of your ownership we. Monthly depreciation monthly interest tax rate monthly tax amount 22222 7980 00725 2190. Dont count the miles you spend.

Value of Car After n Years Purchase Amount 1 - Percentage Rate of. You can then calculate the depreciation at any stage of your ownership. 2500 x 0585 146250 and 2500 x 0625 156250.

This new car will lose between 15 and 25 every year after the steep first-year dip. Now heres the equation to calculate the monthly tax amount. For year 1 multiply the purchase price by the first year depreciation rate and subtract the result from the price.

If you want to calculate MPG and compare car gas. Car Depreciation Per Mile The average car can depreciate as much of 008 per mile according to some sources. This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles.

This calculator may be used to determine both new and used vehicle depreciation. The Rand McNally mileage calculator will help you determine the mileage between any two destinations. Car Age 2 years 3 years.

Own years 2. Find the depreciation of your car by selecting your make and model. As a general rule you can use a simple formula in order to get a ballpark idea of a vehicles value after depreciation.

Use this depreciation calculator to forecast the value loss for a new or used car. Adding them together gives you 3025. So the average cost of driving per mile is.

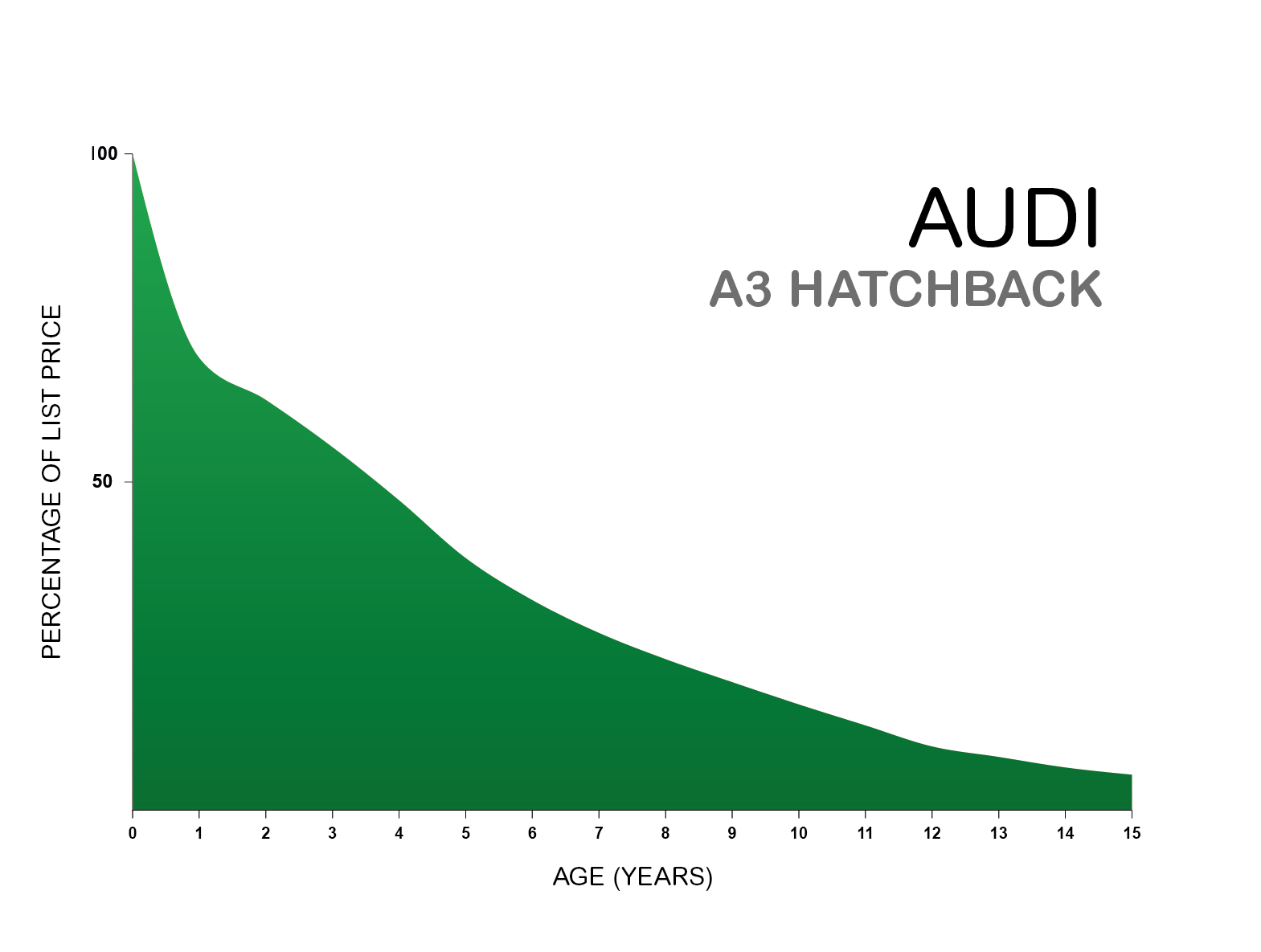

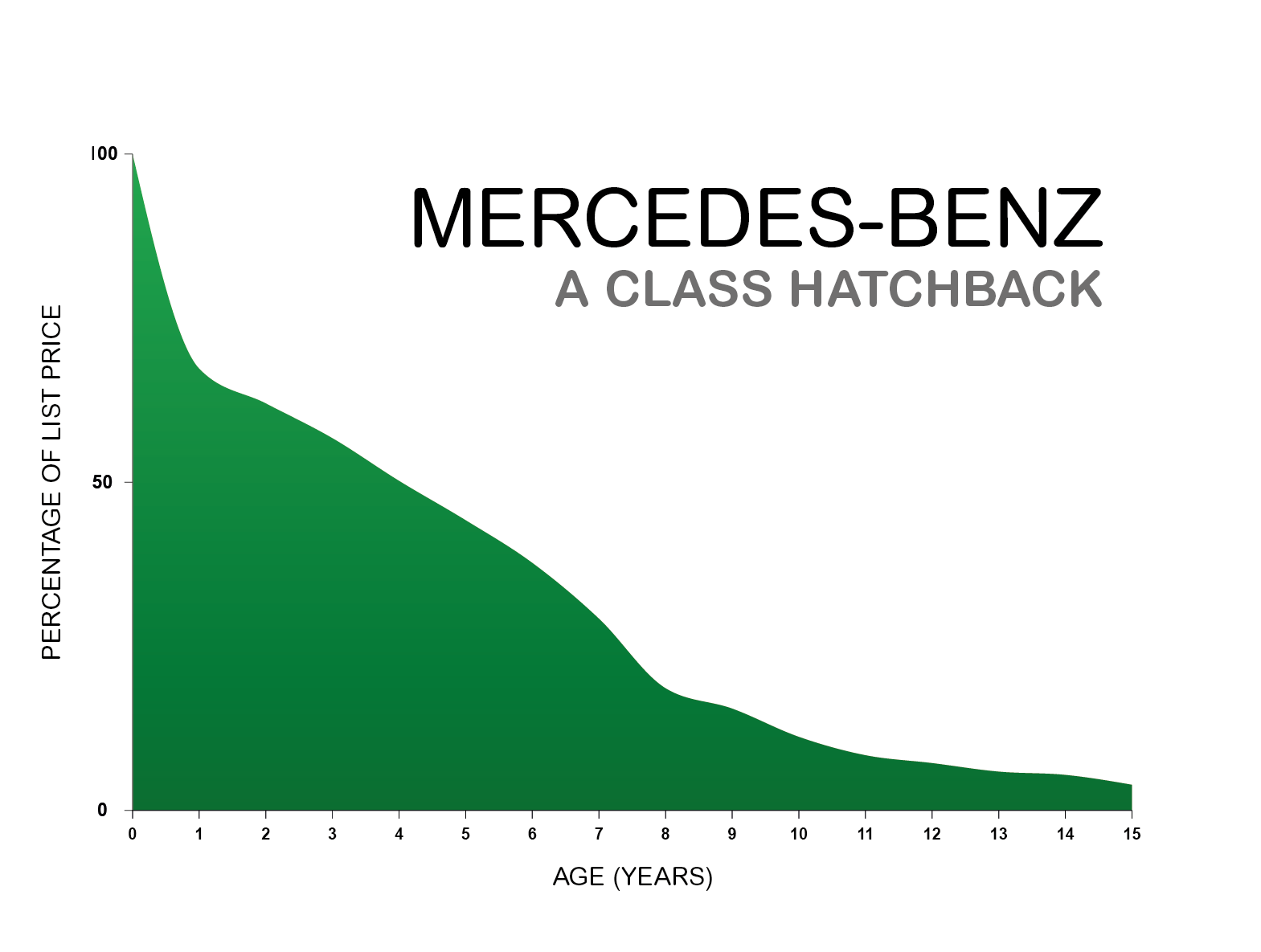

AFTER FIVE YEARS. For all remaining years multiply the previous years reduced value by the current. However different cars depreciate at different rates with SUVs and trucks generally.

Our Car Depreciation Calculatorbelow will allow you to see the expected resale value of over 300 modelsfor the next decade. It will then depreciate another 15 to 25 each year until it reaches the five. According to a 2019 study the average new car depreciates by nearly half of its value after five years.

How Much Is Car Depreciation Per Year Quora

Car Depreciation Calculator Online 53 Off Www Wtashows Com

Research Which Cars Suffer From Depreciation The Most

How To Calculate Car Depreciation Burlington Kia

Car Depreciation Mileage Vs Age Vs Condition Concept Car Credit

Car Depreciation Auto Wiki

Car Depreciation How Much It Costs You Carfax

Car Depreciation Explained With Charts Webuyanycar

Car Mileage Ranking Online Tool For The Philippines Carsurvey

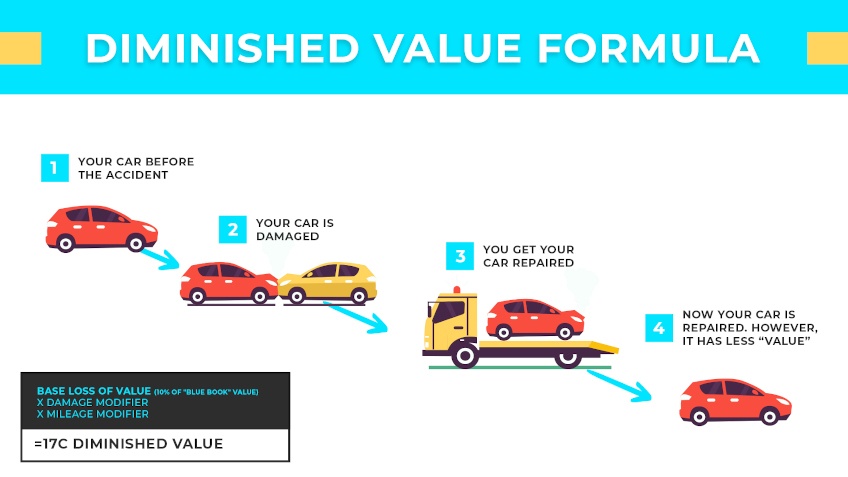

Car Value After Accident How Much Value Does A Car Lose

Research Which Cars Suffer From Depreciation The Most

How Much Is Car Depreciation Per Year Quora

Research Which Cars Suffer From Depreciation The Most

Car Depreciation Online Tool For Philippines Carsurvey

Car Depreciation Expense That Is Often Overlooked Finax Eu

Car Depreciation Explained With Charts Webuyanycar

What Mileage Does A Car S Value Depreciate Direct Car Buying