Quick home equity loans bad credit

How to get approved for a loan even with bad credit. In order to qualify for a home equity line of credit lenders will usually want you to have a credit score over 620 a debt-to-income ratio below 40 and equity of at least 15.

Pros And Cons Of Home Equity Loans Bankrate

Click here for application terms and details.

. From start to finish he was always very available and quick to respond. Recommended Personal Loans For Bad Credit Online. However while some personal loans.

Based on that capacity to repay is calculated and a pre-approval amount is calculated. Bad credit home loans can be up to 95 of the value of the home to be bought meaning youll only need to find the remaining 5 as a deposit in many cases. SKYDAN Equity Partners is the home equity solution you can turn to when banks turn you away because of bad credit.

Bank of America is a big bank lender that offers mortgage and refinance loan products along with full banking services. The funds received from bad credit loans are a function of the borrowers income. We will give you the guaranteed secured no credit loans you need to manage your financial situation.

Free tips to increase your odds of getting approved for a low credit score loan. Speak with a trusted specialist today and see how we can help you achieve your financial goals faster. Home Equity loans up to 1000000 oac.

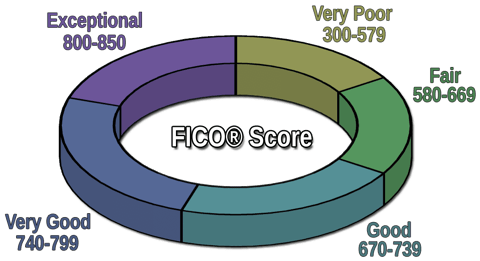

Credit Score chart by NerdWallet First Name Last Name Phone Email. A home equity line of credit HELOC is a revolving credit account that is similar to a secured credit card cash advance except it is secured by your home. Quick Credit loans are offered by CC Connect a division of Capital Community Bank CCBank a Utah Chartered bank located in Provo Utah Member FDIC.

Quick access to money. Interested borrowers can choose from various types of business financing including traditional small business loans lines of credit equipment financing and SBA loans. Loans Canada and its partners will never ask you for an upfront fee deposit or insurance payments on a loan.

Network of dealer partners has closed 1 billion in bad credit auto loans. A home equity loan is a lump sum amount that you repay over a set number of installments. Typically loans are either secured or unsecured.

If you miss payments the lender can foreclose on your home so these loans can be risky. Loans Canada is not a mortgage broker and does not arrange mortgage loans or any other type of financial service. Bad credit applicants must have 1500month income to qualify.

Specializes in bad credit no credit bankruptcy and repossession. When you own your vehicle it you can quickly leverage the value for a quick affordable loan. Can I Receive a Bad Credit Loan with a Previous Bankruptcy on my Record.

We provide online no credit loans and quick cash loans in Ontario Toronto Ottawa Mississauga Brampton Hamilton and others in Alberta Calgary Edmonton Red deer and others Quebec Montreal Laval and others. A line of credit allows the borrower to access funds within the accounts credit limit. Installment loans and line of credit ie credit cards or home equity lines of credit differ in that with an installment loan consumers receive the funds they need upfront and all at one time.

Typically bad credit loans can be anywhere between 500 and 5000 but can go higher. There are more than 5000 branch locations in the US in addition to its. Such as a credit card cash advance personal loan home equity line of credit existing savings or borrowing from a friend or relative may be less expensive and more suitable for your.

Home equity loans. Up to 10000 in loans. National Business Capital is an online lending marketplace with 75 lenders and a business model similar to Lendios.

Easy 30-second pre-qualification form. This is an insurance premium which the borrower pays to protect the lender in case of loan default. Our first phone call was made on a Sunday at noon and he was the only one who picked up his phone and was so calm and easy to work with.

In business since 1999. Its based on the size of the loan and can amount to thousands of dollars. How did you hear about Equity Smart Home Loans.

Our home buy back program allows you to avoid foreclosure settle your outstanding debts improve credit score and avoid predatory high-interest bank loans. We dont want you dealing with the hurdles of traditional home refinancing. If you have bad or poor credit as defined by FICO a score of 350 to 579 you wont be able to qualify for a personal loan unless you apply with a co-signer.

How To Get A Home Equity Loan With Bad Credit Forbes Advisor

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

What Are The Advantages And Disadvantages Of Payday Loans For People With Bad Credit Payday Loans Bad Credit Payday

Home Equity Loans Heloan Regions

![]()

Home Equity Loans A Complete Guide Rocket Mortgage

Using A Home Equity Loan Or Heloc To Pay Off Your Mortgage Credible

How To Get Low Rates On Home Equity Loan Home Equity Loan Home Equity Equity

9 Best Home Equity Loans Of 2022 Money

Home Equity Line Of Credit Heloc Rocket Mortgage

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Can You Use Home Equity To Invest Lendingtree

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

The Loan Vs The Line Of Credit Home Equity Loans Home Equity Loan Home Equity Home Improvement Loans